Personal Loan Rates 2025 – Compare Top Lenders & Save

Personal Loan Rates 2025 – Compare Top Lenders & Save

Introduction: Navigating the Personal Loan Rate Landscape in 2025

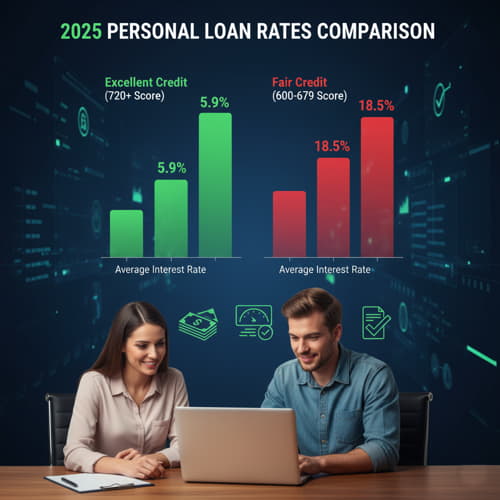

The beginning of 2025 presents a dynamic and often confusing landscape for Personal Loan Rates. With continued economic shifts and fluctuating Federal Reserve policies, consumers in the US need clear guidance to navigate the market and find the lowest possible Annual Percentage Rate (APR). A low APR is the single most important factor determining the true cost of your loan, directly translating to thousands of dollars in savings over the repayment term.

Choosing the wrong lender or simply accepting the first offer can be an expensive mistake. This comprehensive, expert-level guide is designed to empower you with the knowledge to strategically compare top lenders, understand the factors that dictate your individual rate, and implement proven strategies to secure the best Personal Loan Rates 2025 available, ultimately saving you money and accelerating your financial goals.

## The Key Metric: Understanding APR vs. Interest Rate

When comparing loans, you must look beyond the simple interest rate and focus on the Annual Percentage Rate (APR).

- Interest Rate: This is the base cost of borrowing the principal amount.

- APR (Annual Percentage Rate): This is the total cost of the loan, expressed as a yearly rate. It includes the interest rate PLUS any mandatory fees (like origination fees, application fees, or closing costs).

Therefore, always use the APR for comparison. A lender offering a low interest rate but charging a 5% origination fee will often have a higher actual APR than a competitor with a slightly higher interest rate but zero fees.

## Factors That Determine Your Personal Loan Rate in 2025

Your final APR is not random; it is calculated based on four primary factors that lenders use to assess their risk.

1. Your Credit Score (FICO Score)

This is the single most influential factor. Lenders categorize borrowers based on risk: